ARVO 2006: A Further Update on Both Avastin and Lucentis for Treating AMD

Michael Lachman of Lachman Consulting LLC issued his EyeQ Report #6 on May 8th, a summary of the ARVO 2006 meeting recently held in Sarasota, FL, with an emphasis on the latest clinical trial results with Genentech’s Lucentis – the two-year efficacy and safety results for the MARINA trial, a 76-patient randomized controlled Phase III study of Lucentis for minimally classic or occult neovascular wet AMD.

In addition, Michael also reported on the early clinical experience with off-label intravitreal Avastin, Genentech’s already FDA approved drug (for colorectal cancer), but being used off-label as a low cost and low dosage intravitreal treatment for neovascular AMD.

In both cases, the results did not disappoint the physician attendees. Here are some excerpts (with permission from the author) from Michael Lachman’s EyeQ Report #6:

Lucentis Update

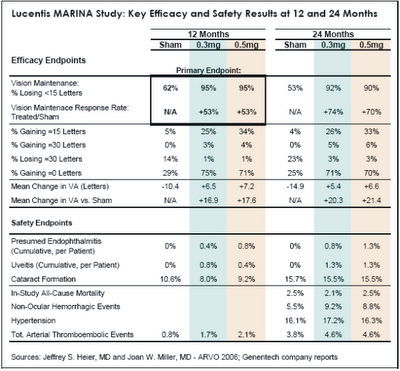

On May 2, Jeffrey S. Heier, MD of Boston reported impressive two-year efficacy results from the MARINA trial. “Compliance at 24 months was good, with 89% of treated patients and 80% of sham patients available for 24-month examination. Treated patients received an average of 22 injections out of a possible 24. As shown in Table 1 below, Lucentis continued to perform exceptionally well during the second year of treatment on all visual acuity metrics, further distancing itself from sham treatment. With regard to “response rate,” or the relative increase in the percentage of patients “maintaining” vision in-line with the primary endpoint, Lucentis improved from 53% to 72% during the second year. In terms of mean change in visual acuity versus sham treatment, the Lucentis-treated eyes gained an additional 3-4 letters during the second year, for a net treatment effect of 20-21 letters (four lines) after two years.”

“During MARINA, investigators were allowed to offer Visudyne photodynamic therapy (PDT) or Macugen to patients at their discretion if they met certain criteria regarding disease progression. Interestingly, over the two year study period, PDT or Macugen was administered to 21% of sham patients but to only 0.4% of Lucentis patients.”

“During MARINA, investigators were allowed to offer Visudyne photodynamic therapy (PDT) or Macugen to patients at their discretion if they met certain criteria regarding disease progression. Interestingly, over the two year study period, PDT or Macugen was administered to 21% of sham patients but to only 0.4% of Lucentis patients.”

On May 3, Joan W. Miller, MD of Harvard Medical School reported satisfactory two-year safety results from MARINA. On key safety metrics, Lucentis was no worse than the sham treatment, and the two Lucentis dosages were similar to each other. With regard to serious ocular adverse events, endophthalmitis occurred in 1.0% of patients through 24 months, and uveitis occurred in 1.3% of patients. These are cumulative rates per patient over 22 injections, not rates per injection; as such, it is not surprising that these complication rates were roughly double the cumulative rates at 12 months.

Importantly, the two-year MARINA safety data is very favorable with respect to key non-ocular adverse events, particularly cardiovascular. In the previously reported 12 month results of MARINA, the rate of arterial thromboembolic events was higher in the two Lucentis groups (1.7% for 0.3mg and 2.1% for 0.5mg) than in the sham group (0.8%). Recall that when Genentech announced the results of the ANCHOR study in January, the company reported that the combined rate of stroke and myocardial infarction in both ANCHOR and MARINA with monthly dosing was similar in the control and the 0.3 mg Lucentis arms (1.3% and 1.6% respectively) and slightly higher in the 0.5 mg Lucentis arm (2.9%). At that time, Genentech seemed to be leaning toward submitting for FDA approval of the 0.3mg dose, because it was only slightly less efficacious than the 0.5mg dose and would avoid many of the questions regarding cardiovascular safety. At the same time, Pfizer/ OSI/Eyetech’s competitive marketing strategy for Macugen seemed to be hanging by the thin thread of Lucentis cardiovascular risk. At ARVO 2006, this thin thread broke.

David M. Brown, MD of Houston reported on a subgroup analysis of the 12-month results of the ANCHOR trial, which compared Lucentis to PDT. According to Dr. Brown, this analysis was used to determine if there is a subgroup of patients for which PDT “has a chance” to outperform Lucentis. There was not such a subgroup identified; Lucentis outperformed PDT in all subgroups based on age, baseline visual acuity, CNV lesion size, and lesion type.

Less Frequent Dosing of Lucentis Appears Very Promising

Philip Rosenfeld, MD, PhD presented the initial experience with less frequent Lucentis dosing from the single-site (Bascom Palmer), open-label PrONTO study. During the Phase I/II extension studies of Lucentis, it was observed that once the scheduled monthly injections stopped, the need for re-injection varied from patient to patient. It was also observed that cysts were visible on optical coherence tomography (OCT) before leakage became evident on fluorescein angiography (FA) or vision declined. In PrONTO, three initial monthly injections of Lucentis (0.5mg) were administered, followed by additional injections based on specific criteria (increase in retinal thickness, visual decline, new CNV leakage, or fluid observed on OCT). During the study, OCT examination was the primary driver of additional injections, as opposed to FA or visual exam. As Dr. Rosenfeld put it, one of the lessons of PrONTO is that “little cysts become big cysts if not treated.”

Visual outcomes in PrONTO were consistent with the MARINA and ANCHOR studies. By month 12, patients had gained an average of 9.3 letters of vision, in-line with the 7-11 letter gain reported at 12 months in MARINA and ANCHOR for the 0.5mg dose. Three or more lines of visual improvement was noted in 35% of patients, and only 18% lost letters of vision. Central retinal thickness decreased by an average of 178μm. There was complete resolution of retinal cysts and sub-retinal fluid in 72% of eyes after one month and 95% by three months.

Avastin Update

Last spring, Philip J. Rosenfeld, MD, PhD and his colleagues at Bascom Palmer looked at the encouraging preliminary outcomes for systemic Avastin and for intravitreal Lucentis, recognized the commercial availability of Avastin and the 400x lower dose if administered intravitreally versus systemically, and took a leap of faith. They started injecting Avastin intravitreally (and very much off-label) for neovascular AMD, and reported their very favorable early clinical experience at the ASRS meeting last July in Montreal. (For more on the results reported at that meeting, see my original report, published earlier on this web site, Avastin: A New Hope for Treating AMD.) The low cost of the drug, about $17-50 per injection in quantities appropriate for intravitreal use, lowered barriers to adoption in the US and internationally. By the winter, intravitreal Avastin had become the global de facto standard of care for wet AMD.

Last week at ARVO 2006, Dr. Rosenfeld summarized the excellent outcomes seen so far with intravitreal Avastin in neovascular AMD patients: average visual acuity from about 20/200 to 20/100, 44% of patients gaining 3 or more lines of visual acuity, and decrease of retinal thickness of about 100μm. As with Lucentis, the duration of effect is variable. Regarding the medical-legal aspects of off-label Avastin use, Rosenfeld argued that it is legal, ethical, and the logical application of scientific and clinical knowledge to patient care. Another prominent retina specialist pointed out that, given all of the investigator-sponsored research that is being conducted and reported for Avastin in retinal diseases other than AMD (see more on this below), Lucentis will be “more off-label” than Avastin for these non-AMD applications.

With off-label use of Avastin growing and FDA approval of Lucentis likely less than two months away, hot topics of discussion at ARVO were various pricing scenarios for Lucentis and what would happen to Avastin use following FDA approval of Lucentis:

Key Question #1: How will Lucentis be priced in the US?

Eyetech set a high bar with its $995 per dose pricing of Macugen, resulting in an annual cost of about $6,000 per year based on six injections (or about $8,000 per year based on the labeled six-week interval). Lucentis has proven to be significantly more effective, and should be able to command a higher price. Although the pivotal MARINA and ANCHOR studies of Lucentis featured monthly dosing, Bascom Palmer’s PrONTO study strongly suggests that less frequent dosing (5-6 injections per year instead of 12-13) is equally effective. Results from Genentech’s Phase IIIb PIER study, which examines a less frequent dosing regimen of Lucentis that also results in six injections during the first year of treatment, should be available to the FDA this month, in advance of the June 30 FDA action date. As such, it is possible that this less frequent dosing regimen could be incorporated into the Lucentis label. The significance of this from a pricing standpoint is that Genentech would be able to support per-dose pricing for Lucentis based upon an average of six treatments during the first year, not 13.

Lachman also heard at ARVO that Genentech is pursuing the 0.5mg dose for Lucentis in the US, instead of the 0.3mg dose. After Genentech reported ANCHOR trial results in January, which raised the possibility of elevated cardiovascular risk for the higher dose, comments from management suggested a bias toward the lower dose despite its somewhat lower efficacy. This would have been the more conservative path, one that the company characterized as having a “low likelihood of being wrong.” We have heard that since that time, the company and the FDA have gotten comfortable with the safety profile of the more efficacious 0.5mg dose, a conclusion supported by the recently announced and very favorable two-year safety results from MARINA

Given the superior efficacy versus Macugen, an average of six treatments per year, and high dose formulation, we would not be surprised to see Lucentis priced in the US in a range of $2,000-$3,000 per dose. Pricing below $1,500 per dose seems highly unlikely.

Key Question #2: What Will Happen to Avastin Use Once Lucentis is FDA-Approved?

Because Avastin is formulated and priced for intravenous infusion for the treatment of colorectal cancer, it is very inexpensive in the small quantities used for intravitreal retinal injection (25-30 syringes per vial of Avastin, costing $50 or less per dose). The fact that Medicare is not currently providing reimbursement for the off-label drug is a relatively small annoyance to retina specialists; the lack of reimbursement for the injection, which would normally be over $200, is a bigger deal. In some cases, private insurance is covering the Avastin injections or patients are paying out-of- pocket (generally $300-500 for the drug and injection). In other cases, retina specialists are “eating” the cost, in the name of providing the best available therapy for their neovascular AMD patients.

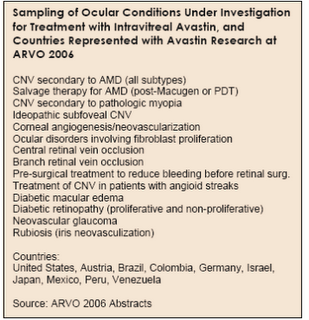

Once FDA-approved, despite its inevitably much higher cost, Lucentis (drug and injection) will be reimbursed by Medicare for the treatment of neovascular AMD. Because of reimbursement, as well as the medical-legal benefits of using an on-label drug when possible, Lucentis will likely be used for patients that are fully insured (either private insurance or Medicare plus supplemental insurance to cover the 20% co-pay). Avastin will likely still be used for uninsured or partially-insured AMD patients in the US that cannot afford Lucentis, as well as for the many off-label indications that are being treated with intravitreal Avastin (see Table 2 below).

Internationally, where healthcare spending is more tightly constrained, Avastin will be much more difficult to displace. Longer term, it is likely that organizations such as CMS and NIH will initiate randomized, controlled studies to validate the safety and efficacy of intravitreal Avastin, given the enormous potential savings to the Medicare system.

Other Uses for Avastin

Avastin is now being used experimentally for a wide variety of retinal conditions. Reports from around the world describing these initial clinical experiences with Avastin dominated the scientific program at ARVO 2006. Our search of the ARVO abstract database turned up 86 posters and papers referencing Avastin/bevacizumab, versus just 14 last year, all 14 of which described systemic use (see the chart on Page 3 of the EyeQ Report). Some of the ocular conditions for which experience with Avastin was reported at ARVO 2006, and the countries of origin for this research, are listed in Table 2 below. To detail all of these research results here is beyond the scope of this report, but with few exceptions, intravitreal Avastin led to one or more of the following outcomes: (1) improved visual acuity, (2) decreased central retinal thickness and vascular leakage, and (3) favorable safety profile. Finally, although clinical experience with intravitreal Avastin is clearly in its earliest stages, there appears to be no “red flag” or “smoking gun” that would suggest an underlying issue regarding safety or efficacy. Over the past several years, intravitreal Kenalog (triamcinolone) has become the default “wonder drug” used to treat a variety of retinal conditions, including AMD (in combination with PDT), macular edema, and retinal vein occlusion, despite known risks of cataract formation and elevated IOP. Avastin has quickly taken over this role from triamcinolone, with apparent advantages in both safety and efficacy.

Finally, although clinical experience with intravitreal Avastin is clearly in its earliest stages, there appears to be no “red flag” or “smoking gun” that would suggest an underlying issue regarding safety or efficacy. Over the past several years, intravitreal Kenalog (triamcinolone) has become the default “wonder drug” used to treat a variety of retinal conditions, including AMD (in combination with PDT), macular edema, and retinal vein occlusion, despite known risks of cataract formation and elevated IOP. Avastin has quickly taken over this role from triamcinolone, with apparent advantages in both safety and efficacy.

(With much thanks to Michael Lachman for allowing me to reproduce excerpts from his report. For more detailed information, I urge you to read his full report at the link provided herein.)

Author’s Note on Avastin

Since the original posting on January 31st, I have added five updates on this important drug for treating age-related macular degeneration. In addition to the posting you are reading, here is a listing (with links) to the others:

Avastin: A New Hope for Treating AMD

Avastin Update: Medicare not Likely to Cover its Use

Avistin Update II: AAO supports Medicare Coverage for Off-label Avistan Use

Also, on June 30, 2006, Lucentis was approved by the FDA. Here is the link:

Avastin/Lucentis Update 4: FDA Approves Lucentis for Treating Wet AMD

Avastin Update 5: NIH Considers Comparing Lucentis and Avastin (August 2006)

1 Comments:

Great work guys. Good resources here, very useful. Your web site is helpful. I will bookmark!

- www.blogger.com 2

phentermine

Post a Comment

<< Home